Table of Contents

- 1. What is TDS?

- 2. TDS on Foreign Remittances

- 3. TDS Rates for Foreign Remittances

- 3.1. 1. Payments for Technical Services

- 3.2. 2. Payments for Professional Services

- 3.3. 3. Payments for Royalties

- 3.4. 4. Interest Payments

- 3.5. 5. Payments for Sale of Goods

- 3.6. 6. Dividend Payments

- 3.7. 7. Other Payments

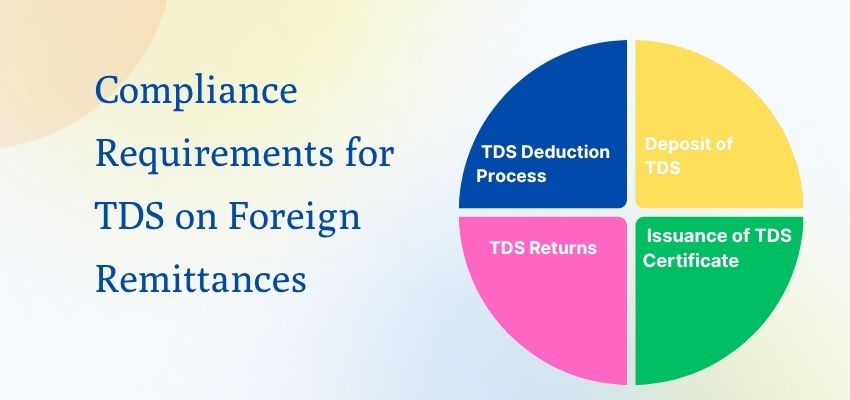

- 4. Compliance Requirements for TDS on Foreign Remittances

- 4.1. 1. TDS Deduction Process

- 4.2. 2. Deposit of TDS

- 4.3. 3. TDS Returns

- 4.4. 4. Issuance of TDS Certificate

- 5. Common Mistakes to Avoid in Foreign Remittance TDS

- 5.1. 1. Improper Classification of Payments

- 5.2. 2. Not Obtaining Tax Residency Certificate

- 5.3. 3. Ignoring Double Taxation Avoidance Agreements (DTAA)

- 5.4. 4. Incorrect TDS Rate Application

- 5.5. 5. Failure to Deposit TDS on Time

- 5.6. 6. Not Filing TDS Returns Accurately

- 5.7. 7. Neglecting Documentation

- 5.8. 8. Ignoring Currency Fluctuations

- 5.9. 9. Assuming TDS is Not Applicable

- 6. Double Taxation Avoidance Agreement (DTAA)

- 7. Best Practices for Managing TDS on Foreign Remittances

- 8. Consequences of Non-Compliance

- 9. Conclusion

- 10. FAQ

- 10.1. 1. What is TDS on foreign remittances?

- 10.2. 2. When does TDS apply to foreign remittances?

- 10.3. 3. Who needs to file a TDS return?

- 11. Other Related Links

Businesses often send money to other countries for a variety of reasons, such as to pay for services, fees, or investments in a globalized economy. To follow Indian tax rules, it is important to know what Tax Deducted at Source (TDS) means for these transfers.

Based in Delhi NCR, Tripathi & Arora Associates gives you a lot of information about TDS rates and how they affect money sent from abroad. This guide tells you everything you need to know about TDS on foreign transfers, such as rates, how to comply, and the best ways to do things.